Introduction to selling gold

Selling gold in the UK, whether it be gold jewellery or scrap gold can result in some quick cash. Understanding the process is crucial to achieving the best price for your gold and ensuring you sell in a safe and secure environment. We have created a guide to walk you through the steps you need to take before, during and after selling your gold in the UK.

Identify your gold

There are 3 key details required to sell gold in the UK, these include the gold type, gold purity (carat/fineness), and weight.

Types of gold you can sell in the UK

Gold comes in many forms, from jewellery which can be worn to gold coins and bars which are typically bought as investments. There are many other types of gold you can sell including gold salvaged from electrical components, dental gold and any other scrap gold. Generally speaking if your item is made of solid gold, a gold buyer will be able to buy this from you and recycle the gold content.

Gold Jewellery: Selling gold jewellery including rings, bracelets, bangles, necklaces is easy in the UK as the items have strict hallmarking rules to help identify fineness.

Gold Bars: Gold bars come in various weights, some larger bars are purchased as investment pieces whereas lower weight gold bars are often gifted or bought by collectors.

Gold coins: Bought by collectors and investors. British minted coins such as Sovereigns and Britannias are frequently traded in the UK.

Scrap Gold: Scrap gold refers to gold items that are broken, or damaged and sold purely on purity and weight.

Gold that is resellable, and in its purest form is the easiest to price and sell. Such as gold bars, and gold coins which require no processing and can be immediately resold after testing and verification.

Gold in other forms such as gold plate or rolled gold requires a lot of processing to extract the gold content and is generally priced low or not bought at all by gold buyers. If your plated gold piece is an antique it may have some value to a vintage or antique collector rather than being sold to a scrap gold buyer.

Gold in different colours (rose/white/yellow) of the same carat has the same fine-gold content. When sold for its gold content, the pricing should be the same across the various colours.

Gold purity & hallmarks

The UK hallmarking system verifies precious-metal fineness. Items described as gold above the legal exemption weights (1g) should bear a UK Assay Office hallmark or a recognised Common Control Mark (CCM) to identify the gold purity. Gold is usually mixed with other alloys to adjust the hardness and colour of the finished metal.

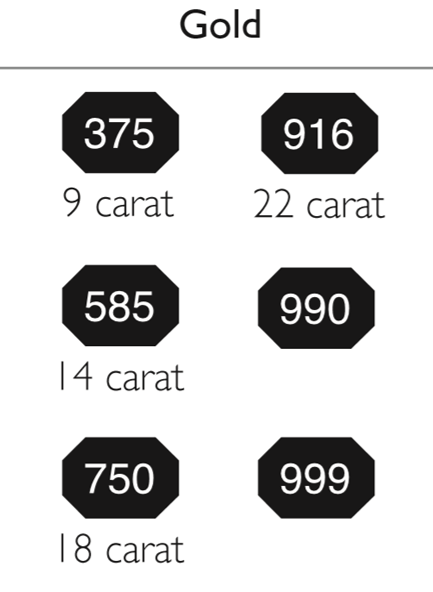

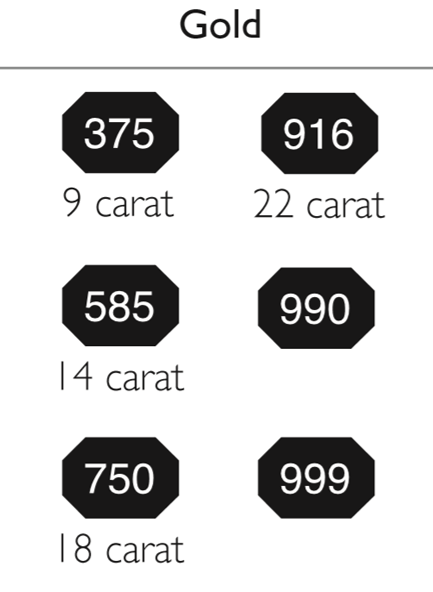

Some of the common gold purity hallmarks you will see in the UK are:

‘375’ this indicates 9 carat gold or 37.5% pure gold

‘750’ this indicates 18 carat gold or 75% pure gold

See the hallmark chart below for more information.

It’s important to note that gold jewellery imported into the UK such as Asian gold (including Indian gold) may not carry hallmarks or may feature hallmarks that are inaccurate, as other countries do not have as strict laws around hallmarking as the UK. If you do not have any easily identifiable hallmarks on your gold jewellery your local gold buyer will be able to test your gold for you using acid identification or XRF scanning to establish it’s true purity.

If your gold is not hallmarked it can make it difficult selling to a private buyer as there is no identification of the gold content, so selling to a trade gold buyer may be your only option.

Gold weight

Use digital scales to get an indicative gram weight. Please note, this will not be as accurate as a gold buyers trading standards approved and calibrated jewellery scales but will give you an estimate.

Value your gold

Once you know type, carat and weight, you should be well equipped to start obtaining prices or calculating a scrap gold value yourself. The higher the weight, and higher the carat purity will result in a higher gold value.

Many online gold buyers have web based gold price calculators you can use. You can enter the gold weight and purity to get a value estimate. Remember, gold is a globally traded commodity so the price is constantly changing, gold buyers will usually fix their gold price daily or update on a set frequency. Use the Cheshire Gold Xchange gold price calculator now to get a gold value estimate today. Final offers are confirmed after testing and weighing.

As gold is globally traded the price can fluctuate daily, choosing the best time to sell your gold is an article in itself, as there are many economical and political factors that can influence the price. You shouldn’t concern yourself too much on analysing and tracking the gold price, you should focus on obtaining multiple quotes from reputable buyers.

Choosing where to sell gold in the UK

There aren’t many options when looking to sell gold in the UK, your selling location will depend upon the gold type you have. We have listed below a few of the most common locations in the UK.

Specialist gold buyers: Selling gold to a specialist gold dealer is a quick an efficient way to get immediate payment. If you are selling scrap gold, then this may be your only and best option for a fair price, as gold buyers specialise in recycling gold in any condition. You will usually receive an up-to-date price based on the current live gold price.

Jewellers: Jewellers may buy selected pre-owned gold jewellery for resale. Offers for scrap can be lower where resale isn’t intended. Jewellers can be a good option for selling antique or vintage pieces as they may be able to resell the piece at a markup beyond a scrap dealer. However, jewellers may give you a price below scrap for resealable pieces, as a backup strategy if the jewellery does not sell in their shop window, then they can still make a profit scrapping the item.

Auctions: Some sellers prefer to sell via auction, however these auctions are usually populated by trade buyers. You often receive a similar price to what you may have achieved from a specialist gold buyer, however you may be hit with high selling fees and costs that may eat into your returns.

Obtaining gold quotes

Once you have decided on your selling location, it’s now time to start approaching businesses for quotations. Many online gold buyers have gold calculators featured on their websites, allowing you to get quick valuations from multiple businesses. Be sure the calculator you are using features their actual buy prices and not the current live gold spot prices.

Check the gold buyers online reputation and customer reviews. If you are selling gold online we would always recommend selling to a gold buyer who also has a bricks and mortar location rather than a PO Box. Be mindful not to rush to sell your gold to the highest bidder, do your due diligence and company research.

Avoid scams

Like most sectors dealing with high value goods, some businesses will use tactics to lure you in with misleading information. Beware of companies displaying gold spot prices rather than their actual buy prices, this can mislead potential sellers. Some gold buying websites will also display high scrap gold prices but in the small print mention that these prices are on an ‘up to’ basis, meaning they will only pay this price on a high weight of gold. Their gold prices on lower weight, for 1 or 2 rings or a necklace for example are often hidden and much lower than their advertised prices.

Conclusion

Selling gold in the UK is a straightforward process, when purity and weight are verified and pricing is transparent. Exploring your selling options and choosing a reputable buyer is the key to success, be sure to search for local gold buyers, searching in google ‘Sell Gold near me’ or similar should show you a list of local gold buyers.

Cheshire Gold Xchange is a family owned gold buyer with over 15 years experience, and a 5 star rating. We provide transparent pricing per gram from our Warrington store or via our insured postal system.